Does Sage 100 Support Affordable Care Act (ACA) Requirements?

That’s probably a question most Sage 100 ERP customers are asking themselves. And you’ll be happy to learn that the answer is yes. Here’s a look at new payroll options and features to help you manage ACA tracking and reporting.

ACA Overview

In a nutshell, employers with 50 or more full time employees will be required to provide additional reporting on employee and dependent coverage to the IRS beginning in 2015. You can get full details on the IRS.gov website.

Enable Perpetual Check History

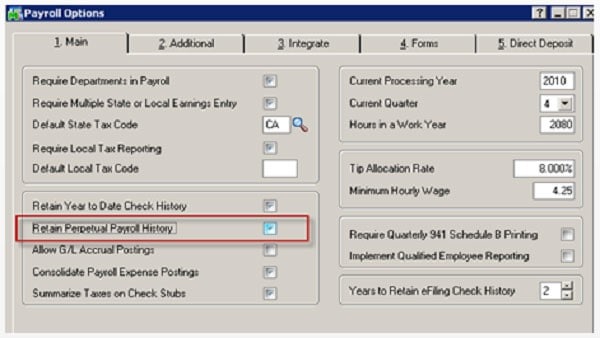

The most important thing to do in Sage 100 ERP is to enable the Retain Perpetual Payroll History checkbox located on the Main Tab in the Payroll Options screen.

This should be done before processing your first payroll in 2015 and for each company code that has ACA reporting requirements.

New Reports and Screens

A new Crystal Report is available in Sage 100 ERP to help you determine if you qualify as an Applicable Large Employer (ALE) that is required to report on compliance with ACA. It’s important to note that if the option to ‘Retain Perpetual History’ is not selected in Payroll Options, no data will show in this report. In addition, new Payroll interface screens and menu tasks allow you to enter and manage the employee or employee dependent health insurance offering data required on various IRS reporting forms.

Sage 100 ERP Versions for ACA Support

As of this article, the current plan from Sage is to release product updates for Sage 100 ERP 4.5 and higher as follows:

Version 2014, Product Update 5 – March 30, 2015

Version 2015, Product Update 1 – April 7, 2015

Version 2013 Product Update 9 – Date TBD

Version 4.50, Product Update 8 – Date TBD

Additional Resources

For additional guidance on ACA Reporting in Sage 100 ERP, please don’t hesitate to Contact Us and/or check out these additional resources:

Sage 100 and ACA Knowledgebase Article

Affordable Care Act Center on Sage City