Automate your collections management process with Credit Hound for Sage 100.

Any small or medium-sized business understands the importance of getting paid on time. Cash flow disruptions can seriously impact a company’s ability to conduct business, potentially leading to mounting debts and serious customer service issues.

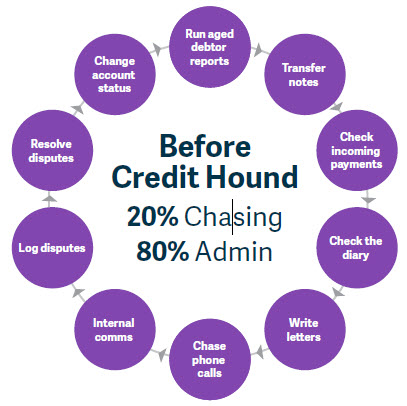

Unfortunately, keeping tabs on late payments can be a significant, time-consuming chore. Administrative tasks such as drafting late payment letters, placing phone calls, and freezing accounts can keep accounting teams bogged down in tedious, difficult work.

A collections management solution that integrates with Sage 100

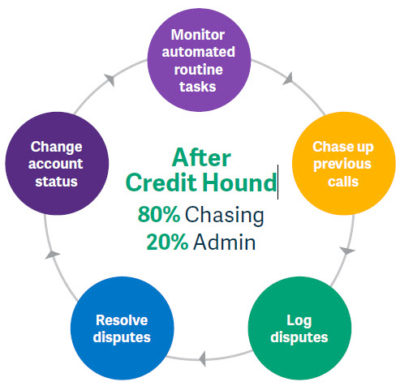

Credit Hound streamlines the hassles of credit control processes. A comprehensive credit control integration for Sage 100, Credit Hound enables companies to automate manual credit processes, speeding up the overall collections management process.

From a clean, customizable dashboard, companies equipped with Credit Hound access real-time account data for a broad overview of creditor status. Common actions, such as issuing account stops, can be automated based on specific business needs.

Credit Hound offers a wide range of benefits

To improve cash flow, Credit Hound’s Chase screen automates the payment chasing process. Multiple overdue accounts from a single company are consolidated into a single payment chase and executed automatically, with a “Pay Now” button automatically attached to customer communications. Follow-up tasks can also be scheduled and assigned to staff members to ensure that nothing slips through the cracks.

Credit Hound allows you to make smarter decisions, faster and track performance.

- Integrates with Sage 100 for real-time access to account data

- Easy to use dashboard of accounting, customer, and credit control information

- Automation of interventions such as when to place an account on stop

- Interactive accounts and aged debtor lists

- Customizable report templates covering aged debt, dispute analysis, promised cash, and more.

Because Credit Hound integrates with Sage 100’s comprehensive platform, it’s also easy to gain clear insights from the entire credit control process.

Because Credit Hound integrates with Sage 100’s comprehensive platform, it’s also easy to gain clear insights from the entire credit control process.

Customizable reporting templates, including aged debt, and interactive age-debtor lists provide organizations a clear picture of how customer accounting is being executed across the board.

Credit Hound can also help improve customer relationships. Rather than tracking down debtors through a painstaking series of phone calls, Credit Hound streamlines the process into an automated workflow. Based on customizable customer rules, Credit Hound automatically distributes payment letters and reminders. Additional information and follow-ups are also recorded, building a clear path for potential dispute management.

Credit Hound helps you improve customer service.

- Automatically send payment reminders according to set rules

- Record details and schedule follow-ups for dispute management

- Improve cash flow

How We Can Help

DWD Technology Group helps companies integrate the best available business functions into their accounting systems. For a full picture of Credit Hound’s capabilities, read the full product brochure about how to get paid faster with improved cash flow.

If you would like a demo or more information about Credit Hound for Sage 100 contact us today.

Register for our Sage 100 newsletter today!