Learn the steps to print and mail and electronically file your 1099’s in Sage Intacct.

In this article, we will go through the steps to print and mail 1099 forms and show you how to electronically file them. If you need assistance with any of these steps or making 1099 adjustments/corrections, DWD Technology would love to help. Please reach out to your DWD Sage Intacct consultant to schedule time. We are also available to help you with the Sage Intacct Year-end processing. View our Intacct year-end process tips today.

The due date for forms 1099-NEC & 1099-MISC is January 31, 2025.

Steps to print and mail 1099’s in Sage Intacct and electronically file them.

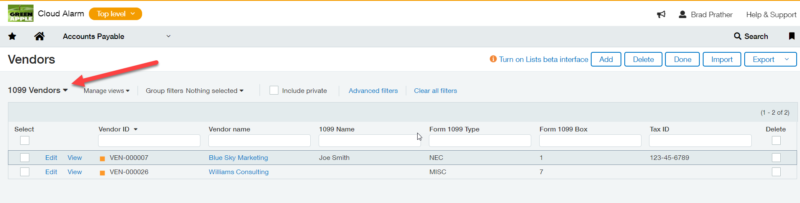

1. Verify that vendors and employees are correctly set up for 1099 treatment

View and verify which vendors and employees are set up for 1099 treatment by creating a custom list view on the appropriate list page.

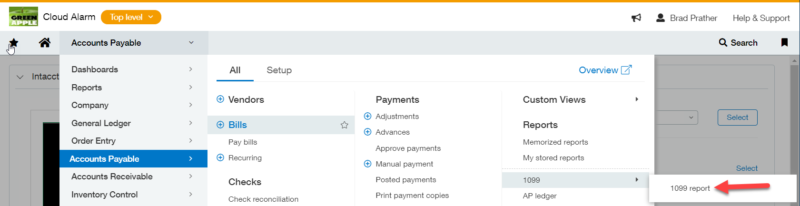

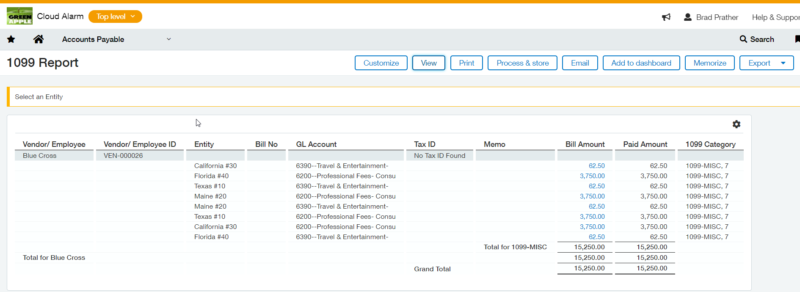

2. Run the 1099 Report

Run the 1099 Report for each form type to verify that:

- Vendors and employees are set up with the correct 1099 form and box

- Taxable amounts are correct

- The total number of forms is correct (for 1096 cover sheet)

- The total amount for all the forms is correct (for 1096 cover sheet)

Important note: Is easier to correct errors before you begin printing, so be sure not to skip this step.

If you are printing and mailing 1099 forms, be sure to follow these steps.

1. Order the correct forms

Tax forms are updated each year. Purchase the latest forms for the upcoming tax season at intacct.dsa-direct.com. You also can find a link to this vendor from the Checks & Supplies center, which you can access from the Sage Help Center.

These tax forms are perfectly aligned for printing and the only ones that Sage Intacct supports. Tax forms purchased from office supply stores or other suppliers are not aligned for printing from Sage Intacct.

2. Prepare printer and print settings

- Print from Adobe reader

- Use a UPD PCL driver installed on your printer

- Verify that your printer has “UPD PCL 6” in the Printer name

- Set Page scaling to None, Actual size, or Fit to page width

- Set Paper size to Letter

- If checked, clear the Rotation option

- Set Orientation to Auto portrait/landscape

3. Print a test form for alignment

- Load your printer with blank paper and print a test 1099 form.

- Compare where each item prints on that blank sheet of paper with an actual 1099 form.

- Verify that the 1099 form type was selected correctly.

- Verify that the printout aligns correctly with the official form.

- Verify the total number of forms (Box 3) on the Form 1096 matches what appears on the 1099 report.

- Verify the total amount (Box 5) matches what appears on the 1099 report.

4. Print on actual forms and mail

If you are filing forms electronically.

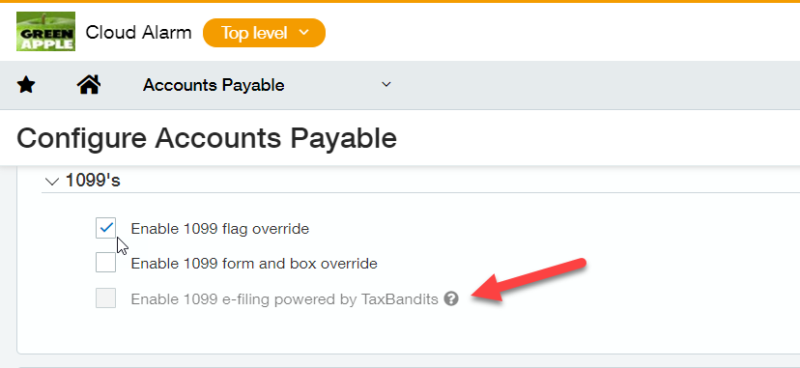

Sage Intacct now has 1099 e-filing integration with TaxBandits. TaxBandits is authorized by the IRS as a 1099 e-filing provider. Eligibility for this limited release is based on a first come, first-serve basis.

Make sure you are subscribed to Sage Cloud Services. You won’t be charged for this subscription.

Go to Configure Accounts Payable and click Enable1099 e-filing powered by TaxBandits.

1. Create a TaxBandits account.

If you want multiple users to be able to view and act on each other’s 1099 batches, create one TaxBandits account for your company. You can only act on batches within accounts that you have sign in information for. The person who creates the account is the admin user. As the admin, add users as Staff Members. Staff members receive invitations by email and create their own unique sign in credentials. When logged in using these credentials, staff members can view and act on the same batches of 1099s for that account.

If you are the only one who to needs view, edit, or e-file the batches of 1099 forms, create your own single-user account in TaxBandits.

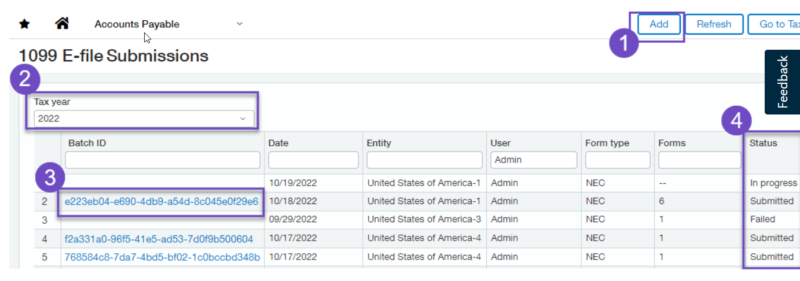

2. Begin the e-filing process in Sage Intacct by creating a batch of 1099 files.

- Select the tax year for which you’re filing.

- When the batch has been successfully submitted to TaxBandits, click the Batch ID link and go to the TaxBandits website to complete the e-filing process.

- Check the status of your batch.

- Depending on how many files are in the batch, it might take some time before it arrives in TaxBandits. You can refresh the page in Sage Intacct to view the latest batch status.

- Troubleshoot batch submission errors using the Action drop-down.

If you need assistance with any of these steps or making 1099 adjustments/corrections, DWD Technology would love to help. Please reach out to your DWD Sage Intacct consultant to schedule time. We are also available to help you with the Sage Intacct Year-end processing. View our Intacct year-end process tips today.

Register for our Sage Intacct newsletter today!