There are three scenarios that can happen with AR overpayments in MIP

- You have received a payment greater than an invoice and wish to apply the excess to other invoices.

- You have received a payment greater than the invoice and wish to refund the excess to the customer.

- You have received a payment greater than the invoice and already applied that payment to the invoice and need to either match it against future invoices or refund it to the customer or track it outside the AR system.

Scenario 1: You have received a payment greater than an invoice and wish to apply the excess to other invoices.

In this scenario go to Enter AR Receipts and select the invoices that are to be used against this payment. The amount you record is the total of all the bills, NOT the entire amount of the payment you received.

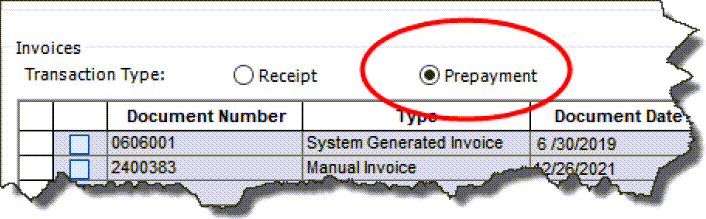

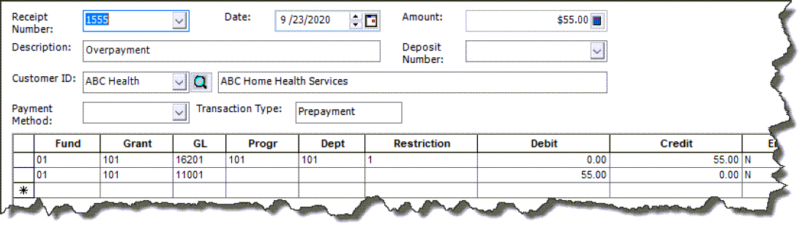

After you have recorded the payment of the bills you will do a prepayment. This is done through Transactions > AR Receipts > Enter A/R receipts. Enter the receipt information (you can use the same document number as the payment). After you select the customer and the list of invoices comes up click the prepayment button.

This will allow you to enter the prepayment. Usually, you will hit your AR and your Cash account (unless you already recorded the receipt of the cash elsewhere).

You will save and Post the session.

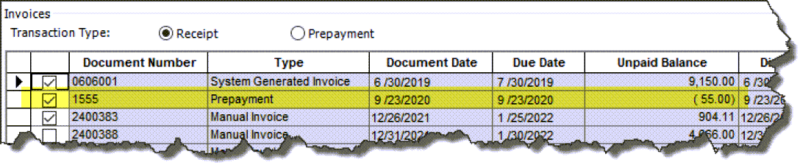

To apply this to future invoices you go through the normal AR Receipt process. When the screen that shows the outstanding invoices comes up you will see the prepayment as a negative. Select it in conjunction with other positive invoices and complete your AR Receipt.

Scenario 2: You have received a payment greater than the invoice and wish to refund the excess to the customer.

In this scenario go to Enter AR Receipts and select the invoice(s) that are to be used against this payment. The amount you record is the total of all the bills, NOT the entire amount of the payment you received. This will zero out those invoices but not account for the full amount of the payment you received.

This leaves the portion of the payment that will be refunded back to the customer to be recorded. You will record this remaining amount with either a JV and a cash receipt hitting your Cash Account or another account of your choice (it cannot be the AR customer account).

Then you will issue a payment to this customer. This payment could be either a Write Check, Cash Disbursement, or AP Payment.

If you plan on doing an AP payment additional steps are required.

Step 1: You must set the customer up as a vendor.

Step 2: When doing the transaction to record the amount of the overpayment you will hit cash and another account. Make note of that account as you will use it in the invoice.

Step 3: When entering the AP invoice, you will use the AP account as the other account that you recorded the overage to. This will reduce the balance of the other account and transfer the balance to AP where it is paid normally.

NOTE: There is no way to automatically tie AR and AP transactions or customers and vendors. They must be done separately.

Scenario 3: You have received a payment greater than the invoice and already applied that payment to the invoice and need to either match it against future invoices or refund it to the customer.

This scenario assumes that when you did the AR receipt that the amount of the receipt was greater than the amount of the invoice. As a result, the invoice now has a negative balance that needs to be taken care of.

In this scenario there are two options:

Option 1: Match the invoice against future charges. In this scenario, we just treat the negative invoice the way we do a prepayment. We select the negative invoice in conjunction with positive invoices. They will net against each other. When the receipt is finished the negative invoice will be liquidated.

Option 2: Move the balance of the overpayment. In this scenario, we do not wish to maintain the balance of the overpayment against the original invoice. We may wish to track it under its own document number for future payments, refund the balance to the customer or track the balance outside the AR system.

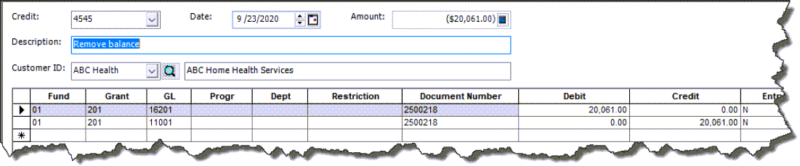

To do this we would use the A/R Credit memo to reduce the balance of this invoice. Go to Transactions > Accounts Receivable > Enter AR Credits. Enter the credit memo number and information. After you select the customer the screen will pop up and you can select the negative amount.

This will bring in the AR side of the entry required to take the invoice to zero.

You will need to put the offset of this entry in. the account used will depend on what you intend to do with the transaction.

If you wish to put this amount into a separate prepayment to be used in future invoices you would usually offset to cash. Then when you enter the prepayment you will put the invoice back into the AR account and Cash.

If you want to refund the money to the customer or wish to keep track of the balance outside the AR system you would use another type of account instead of cash. This might be an ARO, Other Asset, or even a Revenue account. Regardless of the type, the balance is now out of the AR account and you can use other types of transactions to refund the money or move it to where it needs to go. If you wish to refund the money you can use the instructions from the second scenario.

Register for our MIP Fund Accounting newsletter today!

If you need assistance with your MIP Fund Accounting software or have additional questions, please contact our MIP support team at 260.423.2414 or at 800.232.8913.