When it comes to accounting software, Intuit QuickBooks is one of the most popular options on the market. There are two versions to choose from: QuickBooks Online and QuickBooks Desktop Enterprise, each with its own pros and cons.

Because of its widespread use, for this particular article we will be comparing the features and functionality of the QuickBooks Desktop Enterprise version vs Sage Intacct.

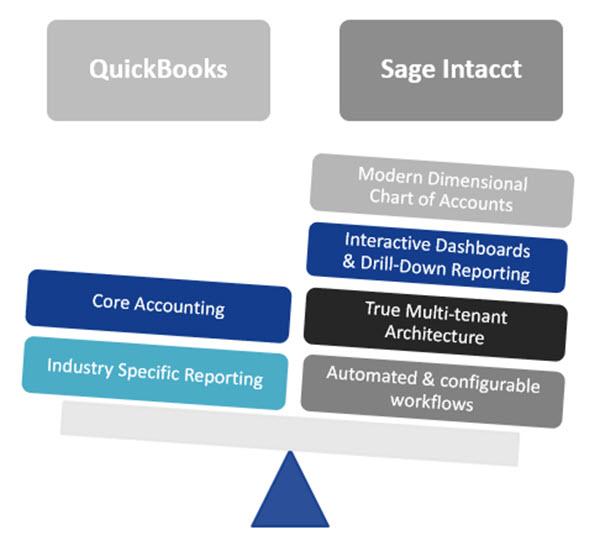

Many small and mid-sized businesses utilize QuickBooks in their early days. However, virtually every growing organization soon realizes the software’s limitations. We want to ensure that you have the right solution to position yourself for success at every stage of your business. Many of our QuickBooks customers have grown and are now considering the differences between QuickBooks vs Sage Intacct to determine whether upgrading their accounting software is the right move.

DWD has been a Sage Software Certified Partner since 2001 and has many years of expertise with both Intuit QuickBooks and Sage Intacct.

What is The Difference Between QuickBooks and Sage Intacct

Why do companies using Intuit QuickBooks switch to Sage Intacct?

- Your business has outgrown the solution (performance-related issues)

- Need for better reporting (financial, operational, compliance and outcomes)

- Need greater visibility over all business activities including desire for financial intelligence, dashboards, and key metrics.

- Need for multi-entity and multi-currency functionality.

- A lack of automation has led you to rely on error-prone manual processes.

- Looking for a way to provide easy access for remote users to connect to your system.

Why growing companies using QuickBooks move to Sage Intacct (click to download 13 pg whitepaper)

QuickBooks Desktop vs Sage Intacct Side by Side Comparison

| QuickBooks Desktop | SAGE Intacct | |

|---|---|---|

| Overall Strengths | User-friendly. Industry-specific reporting. Combine reports from multiple company files. Download bank and credit card transactions into QuickBooks. Track Fixed Assets. User- or role-based permissions. Foreign Currency. TrueCommerce EDI integration. | Born in the cloud, true multi-tenant architecture, modern dimensional chart of accounts, interactive dashboards and drilldown reporting provide instant visibility, automated, configurable workflows, deep vertical focus and automation of key processes. |

| Overall Weaknesses | Once converted to Enterprise, cannot convert back to Desktop version. High volumes of data can slow down the system and/or lead to data corruption. Light audit controls/SOX compliance. Minimal ability to customize data entry screens or add customized functionality. Limited ability to customize forms and reports. | Operational functionality is not a perfect fit for those with manufacturing and advanced inventory needs. |

| Number of Users | Up to 30 | Unlimited |

| Performance & Scalability | Supports larger file sizes. QuickBooks Marketplace provides for add-on features. | Supports larger file sizes, companies and user counts, ability to modify software and workflow with scripting and screen customizations, many integrations available to enhance functionality. |

| Financial Management & Reporting | Minimally customizable reports. | Modern dimensional chart of accounts, interactive dashboards and drilldown reporting provide instant visibility. |

| Ability to Customize | Limited customization ability. | Highly customizable system, you can tailor workflows, data fields, transaction definitions, invoices, report formats and much more. |

| Best Fit Industries | Financial, Manufacturing, Distribution, Construction, Nonprofit | Professional services, Nonprofits, Healthcare, Mental & Behavioral Health, Colleges & Universities, Restaurants, Franchise Business, Financial Services |

| Best Fit Company Size | Small to Medium | Small to Large |

| Deployment Options | On-Premise, Hosted | Cloud/Software as a Service (SaaS) model. |

| Ease of Implementation | Fairly easy to implement. | Smaller software solutions tend to be easier to implement because there is much less flexibility to tailor the system to specific needs. |

| Avg Implementation Timeframe | 1 to 3 months | The average implementation time for Sage Intacct is 3 months. (2 months for the actual implementation + 1 month for testing). |

| Avg Implementation Cost | $8,000 – $12,000 | 1-2 times the cost of the software. |

| Pricing Model | Subscription – single user without payroll starts around $1,800 per year. | Subscription – single user with single entity starts at $8,580 per year. |

| Annual Maintenance Cost | Subscription pricing includes | Subscription pricing includes 4 automatic upgrades per year as well as hosting, maintenance, backups and security. |

Providing a Vision for Growing Businesses

Today’s accounting and finance leaders are expected to not only keep track of past transactions, but also provide a vision for how to move forward.

If your business is growing and you’re making concerted effort to use resources as efficiently as possible, streamlining and optimizing finance processes is one of the most important investments you can make.

Watch this short Intacct product tour created specifically for organizations outgrowing QuickBooks. See the powerful financial accounting, dimensional reporting and dashboards offered in Sage Intacct vs QuickBooks.

Sage Intacct vs QuickBooks Comparison FAQs

Sage Intacct: Modern Cloud Accounting Software

Moving to a modern cloud accounting solution like Sage Intacct will provide you with a more powerful, scalable system to support your ongoing business needs.

Improve Visibility Into Your Business – Start making data-driven decisions with a real-time view of your businesses financial performance. Sage Intacct allows you to quickly drill down with instant visibility to any level of detail you need.

Reduce Manual Process – Stop relying on cumbersome workarounds that leave your team over-reliant on spreadsheets and manual entry. Automated, paperless workflows in Sage Intacct accelerate and streamline routine accounting and reporting tasks.

Break Your Data Out of Information Silos – Most companies using QuickBooks don’t integrate the system with other key applications creating manual integration points between business systems. Sage Intacct allows for seamless integration with other programs giving you the ability to track statistical metrics that are central to your businesses operations.

No matter your industry or business type, DWD can work with you to determine the best path to take with your QuickBooks system.

Sage Intacct is a natural upgrade path for QuickBooks users in many industries.

Next Step: Evaluate the Pros and Cons

Our familiarity with both QuickBooks and Sage Intacct means that we can help you compare the pros and cons of both products for your specific operational needs and business goals. If it’s not the right move, we’ll tell you. If it is the right move, we’ll be there to help you usher in all the benefits of cloud technology.

Take advantage of our free Software Needs Assessment to help you find the best software for your unique needs, whether it be QuickBooks or Sage Intacct. Our experts are here to answer your questions and provide objective advice so you can find the right solution.