Learn how to fix invoices with sales tax errors.

Have you ever incorrectly charged sales tax on an invoice where the customer should have been tax exempt? If you have ever needed to create a Sage 100 Accounts Receivable credit memo for sales tax only, this month’s software tip is for you. The steps below will who you how to correct the taxable and non-taxable sales amounts and issue the credit memo for the sales tax only.

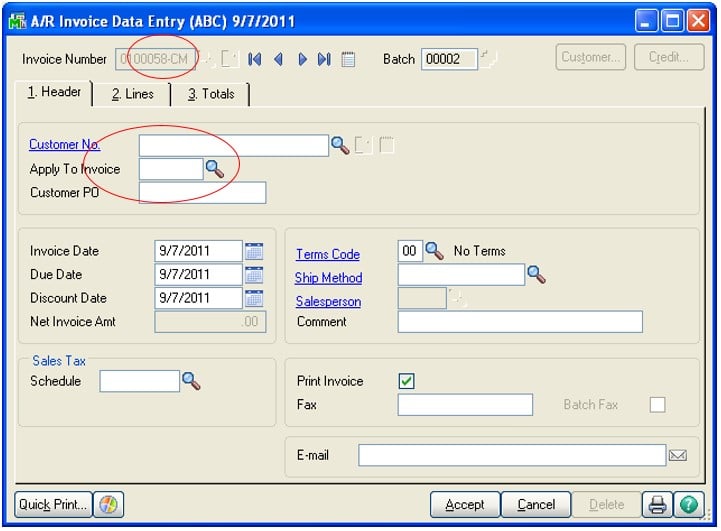

- Open Accounts Receivable/Main/Invoice Data Entry, enter CM in the invoice number field and click on the “Next Number” button to generate a credit memo.

- On the ‘Header’ tab, select the customer. Be sure to select the same sales tax schedule as the original invoice.

- Enter the original invoice number in the ‘Apply to Invoice’ field to apply the credit memo to the invoice.

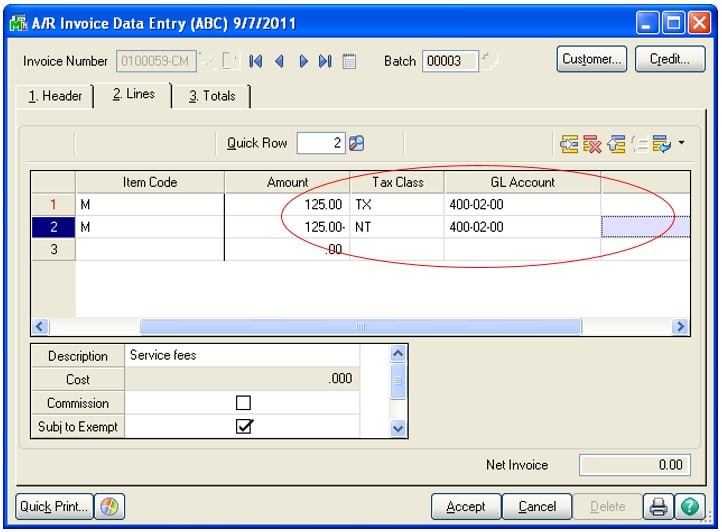

- On the Lines tab, add a line with the following information:

- Miscellaneous Item or Charge Code in the Item Number field. If using the “M” miscellaneous code, specify a GL account.

- Item description on the credit memo, if desired.

- Select “TX” as the ‘Tax Class’.

- Enter the taxable sales amount from the original invoice as a positive amount. Click ‘Ok’ to accept the line.

NOTE: Credit memos are normally entered with positive amounts. A negative on a credit memo will actually be an addition to the non-taxable sales amount.

- Enter a second line with the following information:

- The same Miscellaneous Item or Charge Code (or “M” code with same GL account as above).

- Select “NT” as the tax class.

- Enter the taxable sales amount from the original invoice as a negative amount. The two line items should have a net value of $0.

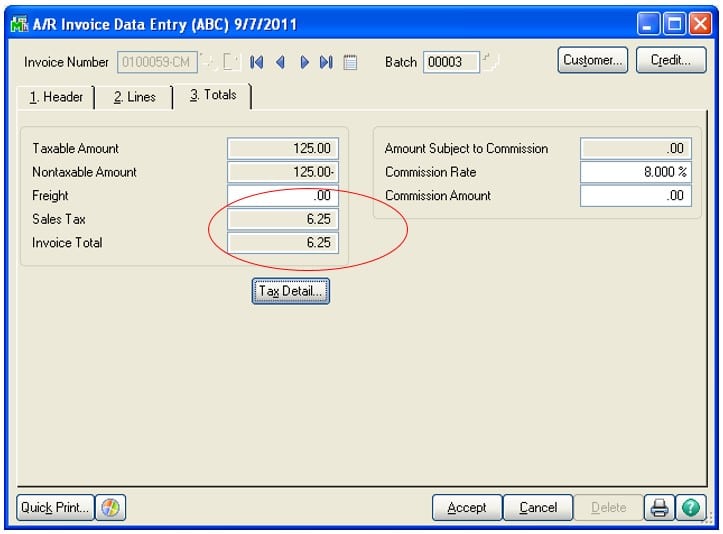

- On the ‘Totals’ tab, note that there is a positive amount in ‘Taxable Amount’ field (reducing the taxable sales) and an offsetting negative amount (increasing the non-taxable sales) in ‘Nontaxable Amount’ field. The total amount of the credit memo should be the original sales tax amount (as a positive number). Confirm that this is the correct tax amount and then click ‘Accept’.

- Post the Sales Journal.

For more information or assistance with creating an accounts receivable credit memo for sales tax only, contact our Sage 100 support team at 260.423.2414.

Register for our Sage 100 newsletter today!