With Sage 100, if the user doesn’t correlate the Accounts Receivable (AR) or Accounts Payable (AP) Invoice document date with the date that the documents are posted to the General Ledger (GL), there can be a discrepancy with the Invoice Aging Report matching the GL.

There are a few actions the user can take to resolve this discrepancy. The process is basically the same between AR and AP. Let’s look at the process to reconcile Accounts Receivable.

In an ideal world, the GL will reconcile with the Aging. Because this report in Sage is based on the DOCUMENT date of the invoices, and not the GL date, timing differences could keep this report from reconciling to the GL for the same period. To determine whether or not a discrepancy is related to timing differences, let’s look at the most future balance of the General Ledger and compare it to the most future balance of the Aging report.

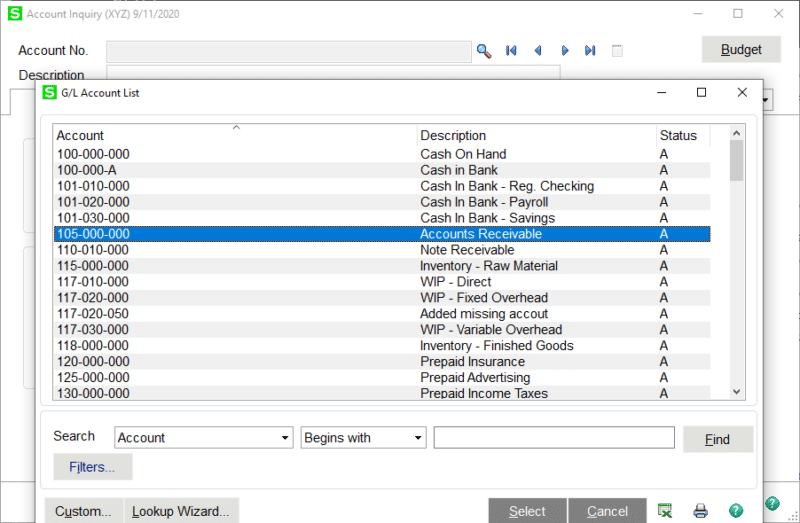

Using General Ledger > Main > Account Maintenance (Inquiry), select the Accounts Receivable account.

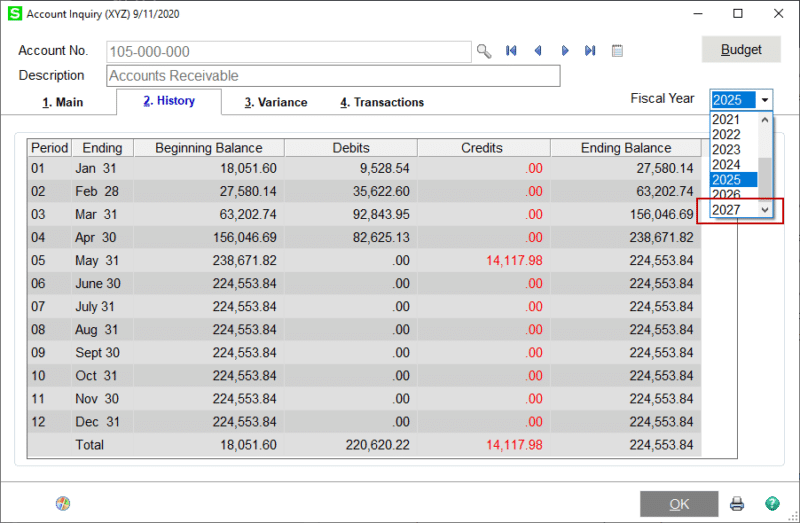

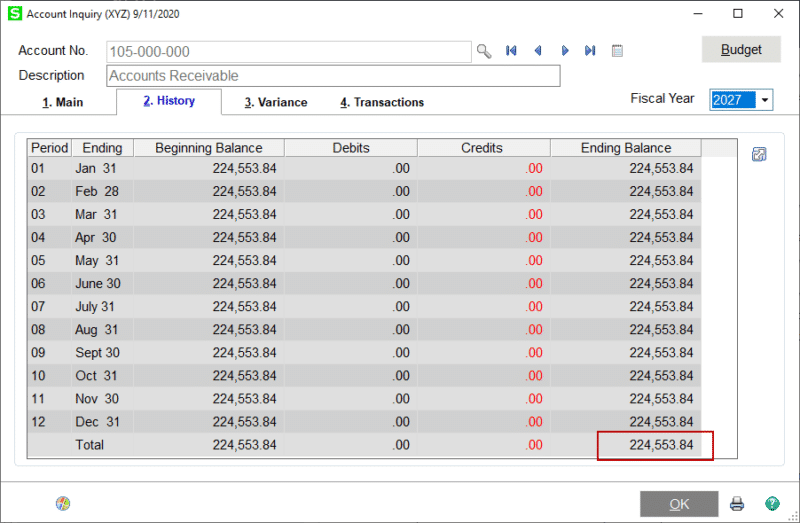

Select the History tab and find the most future fiscal year available in your company:

This ending balance is the most future GL balance that exists for the account. This needs to be compared to the most future Aging Report balance.

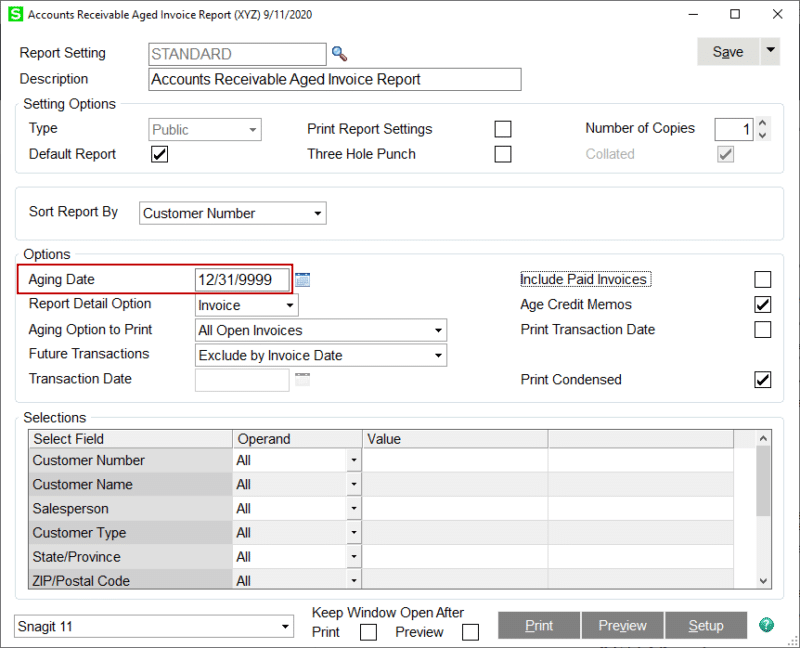

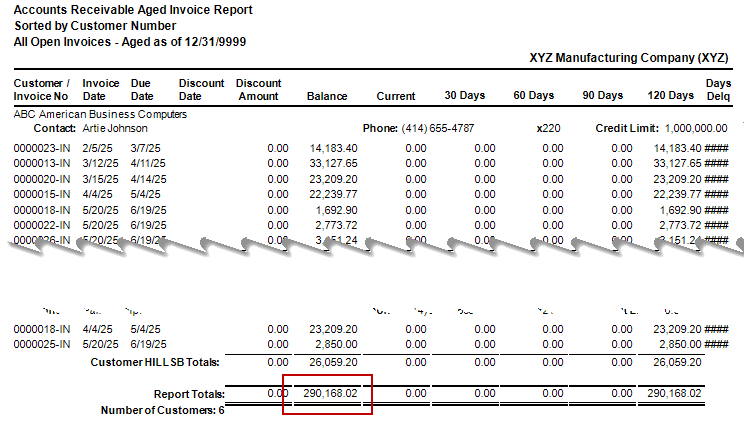

Run the AR Aging Report (Accounts Receivable > Reports > Accounts Receivable Aged Invoice Report) with an “infinite” date.

If your “infini-balance” on the Aging Report matches the “infini-balance” in the GL, then any interim discrepancies are merely timing differences because document dates and posting dates didn’t fall within the same period.

In our case here, the Aging Report is not the same as the GL balance. This means we need to research which side is correct – GL or AR. Typically, we can “prove” the Aging Report because we have physical documentation that should correspond to all the listed open invoices. Regardless, something would need to be adjusted, and if the details of the Aging report are correct, then the GL needs to be adjusted to match. If the Aging report is incorrect, details need to be adjusted and compared to the GL for any further corrections.

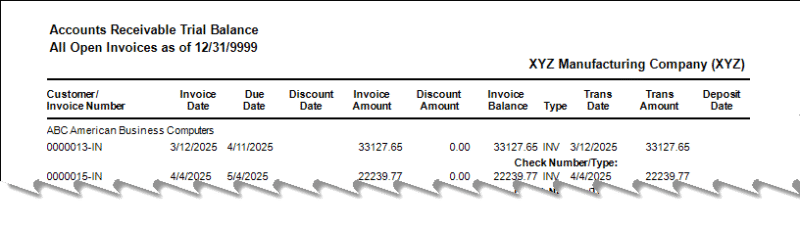

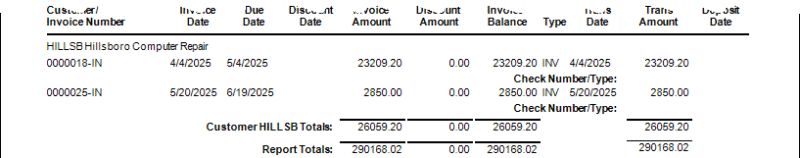

There is another report available in both Accounts Receivable and Accounts Payable. This is the AR(AP) Trial Balance Report. This misunderstood report is actually used to more effectively reconcile Accounts Receivable (Payable) to the General Ledger on a period by period basis.

This report also allows to run by a specific date. The presentation of the Trial Balance Report shows the activity affecting Accounts Receivable (Payable) through the specified date. Invoices, as well as Payments, are shown with not only the document date but also the GL Transaction date.

Seeing transactions in this way allow for visibility into timing issues. Looking at this report through the “end of time” should also provide the “infini-balance” of the Receivables (Payables) account.

When this report gets ran for the end of a specific period, the balance should reflect what is on the GL for that same period. Using the TRANS DATE (Transaction Date) column will let you know when the GL was affected, with respect to the document (Invoice) date.

Using the different reporting tools available within Sage 100 can give you guidance as to what may need to be corrected when your details do not correspond with the balance on the General Ledger.

If you have questions or would like assistance with AR or AP to General Ledger in Sage 100, please contact our Sage 100 support team at 260.423.2414.

Register for our Sage 100 newsletter today!