Before the transition of the Payroll Module from the Legacy version to the New Business Framework, modifying reports was often challenging.

One either needed to have a Master Developer rewrite the code behind a payroll report that was already on the Reports menu, or a report had to be developed and added to the Custom Reports menu.

Now that the Payroll Module has been updated, modifying Reports within Payroll can be accomplished with Crystal Reports.

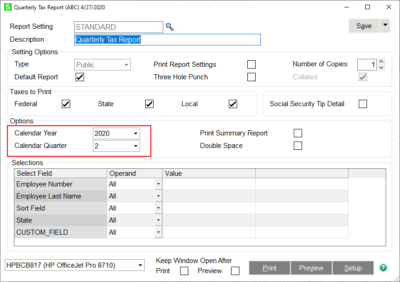

In addition, many of the reports have been revamped to allow for reporting across different quarters and calendar years. Other reports have been combined but allow for multiple options within the same report.

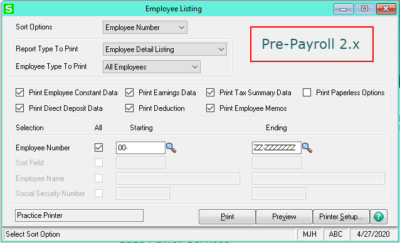

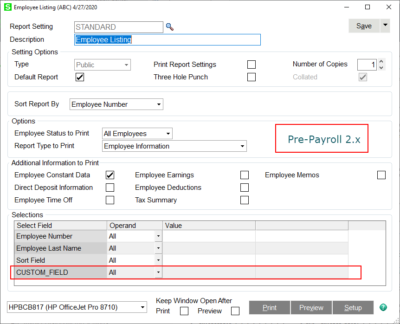

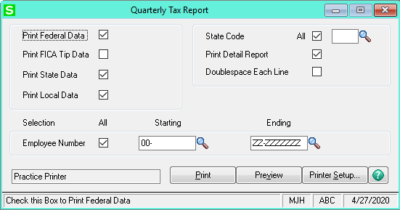

In Payroll prior to Payroll 2.x, there were some limitations on how various reports could be run.

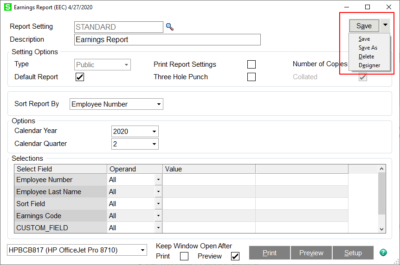

With Payroll 2.x reports, you now have the ability to save customizations that don’t have to reside in the Custom Reports folder. Also, you have options to keep the print window open after Printing or Previewing.

Also, if there are User-Defined Fields (UDFs) on the Employee Maintenance screens, those potentially can be used for additional selection criteria.

One of the main reports that previously had been limited to reporting only on the currently open Quarter was the Quarterly Tax Report. As a result of the redesign of the Payroll Module, reports such as the Quarterly Tax Report now have visibility over prior quarters and even prior years.

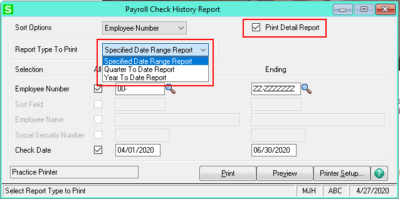

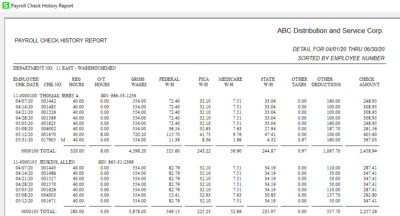

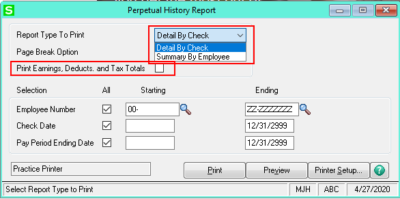

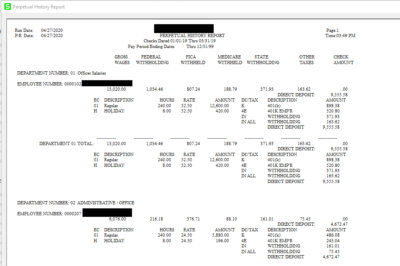

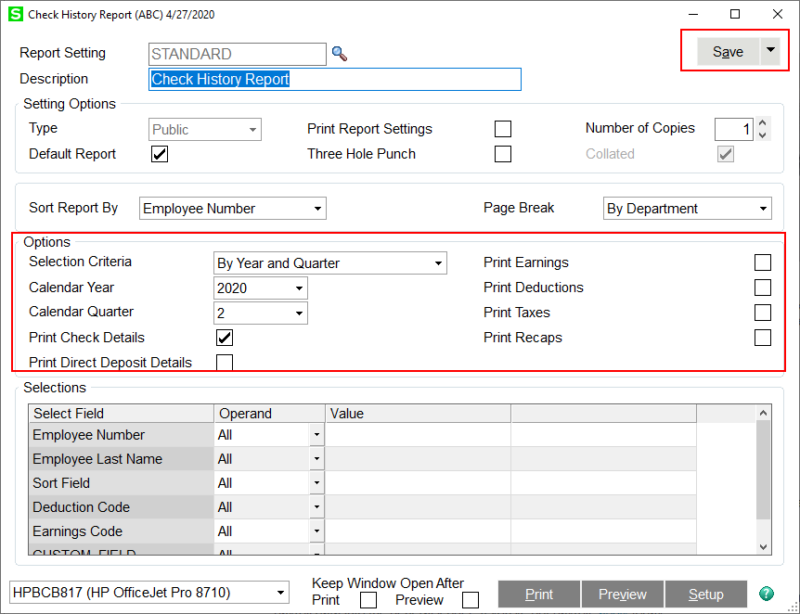

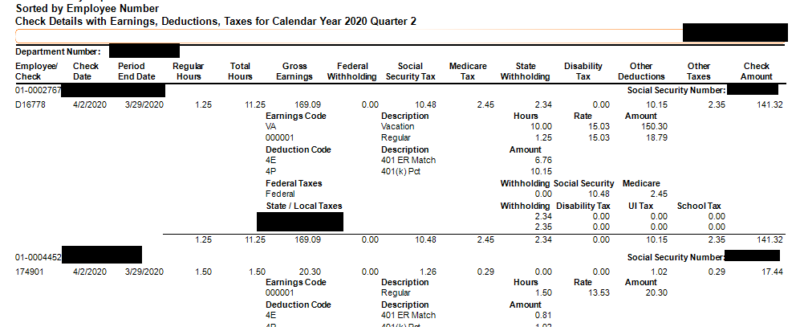

An example of reports that have been combined includes the Payroll Check History Report along with the Perpetual History Report to yield the Check History Report.

Selecting various checkboxes from the new Check History Report can mimic all the elements of the old Payroll Check History Report and the old Perpetual History Report.

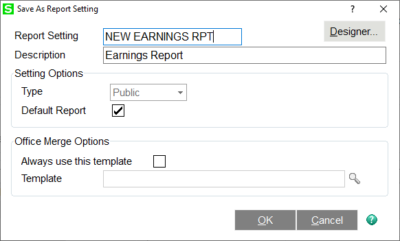

As long as you have Crystal Reports installed on your workstation and the appropriate rights to access and edit, you can make modifications to your Payroll Reports. Simply SAVE a copy of the report and then select DESIGNER.

If this new Report Setting is the one you want to access each time you get into the respective report, make sure to mark as the Default Report. Crystal Reports then will open, and you may edit the report to reflect your desired changes.

As you can see, substantial changes have been made to Payroll Reporting. All the standard Payroll Reports are customizable with Crystal Reports. Some reports have been combined for greater flexibility, and others are no longer limited by the module’s current quarter.

For more information or assistance with Sage 100 Payroll, be sure to check out some of our Sage 100 Payroll software tips or contact our Sage 100 support team at 260.423.2414.

Register for our Sage 100 newsletter today!