When you are processing prepayments on a Purchase Order (PO), there are two important considerations to remember:

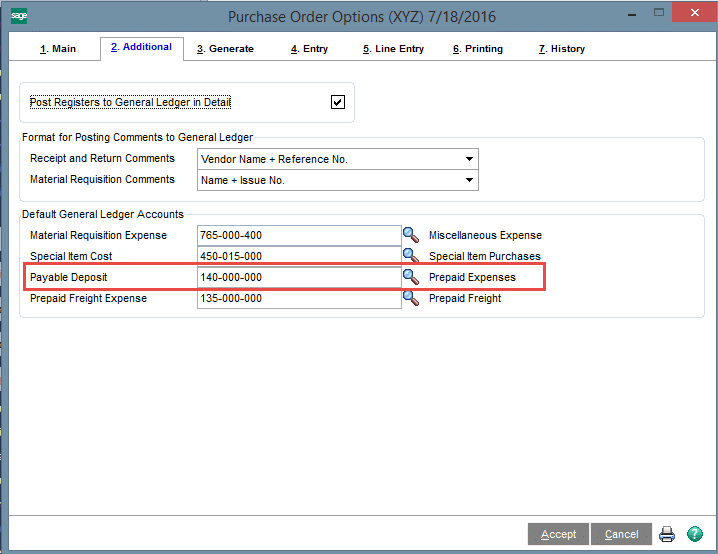

- You must know the G/L account that is assigned to the Payable Deposit on the Additional Tab of Purchase Order Options (Purchase Order > Setup > Purchase Order Options).

- Remember that this process is not integrated, you must update the PO module manually before or after you process payments in Accounts Payable.

Process Steps for recording Prepayments for Purchase Orders:

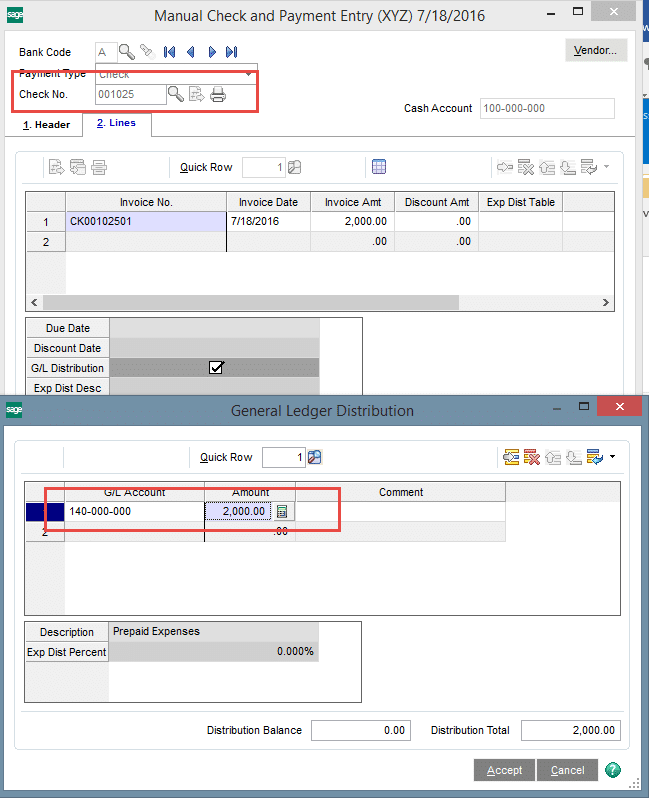

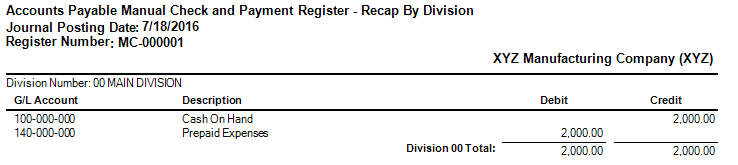

- Write Manual Check, posting to GL Payable Deposit Account, or create an AP Invoice to vendor, posting to Payable Deposit Account (specified in step 1) and write check against this invoice. (This will debit the deposits account specified in PO options.)

-

- As an alternative, you may create an AP Invoice to the vendor, as long as the invoice is expensed to the Payable Deposit Account identified in step 1 above.

-

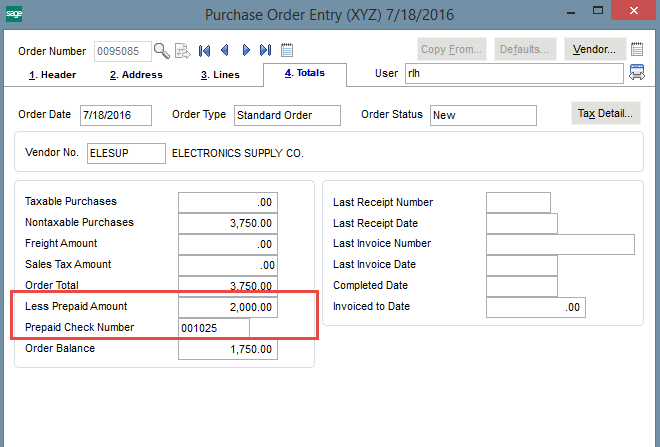

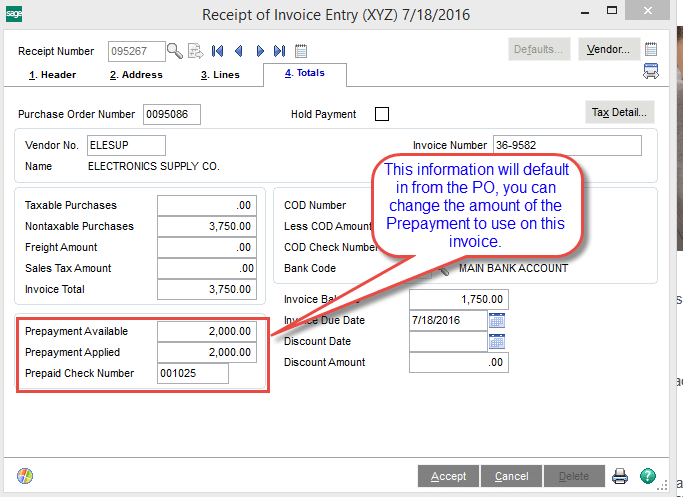

- Create PO with prepayment amount identified on the Totals tab (it may be all or part of the product amount due).

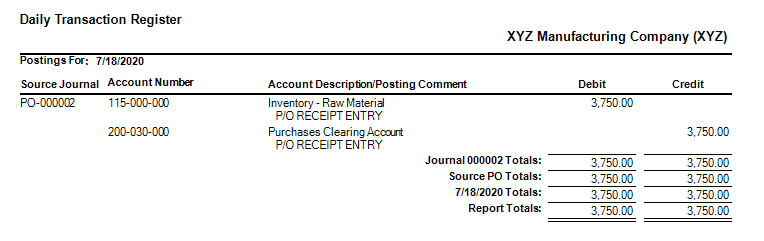

- Receive Goods against PO as normal. (This will do its normal Debit to inventory and Credit to account 200-030-000 – Purchases Clearing Account).

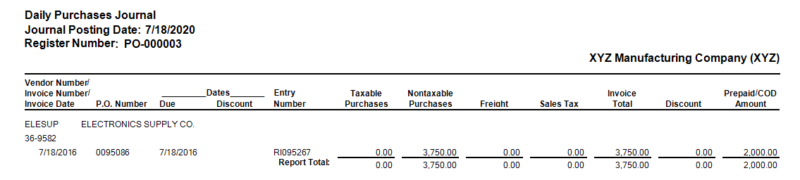

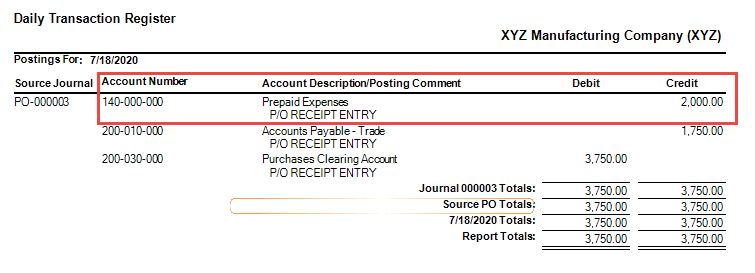

- Do a Receipt of Invoice entry against this PO (even if the PO was prepaid in full – creating this invoice will help keep the records straight that this PO may be closed). This will clear the deposits account and the Accrued Purchases account to keep everything in balance.

- Update the registers and everything will be in balance.

If you have questions or would like assistance, please contact our Sage 100 support team at 260.423.2414.

Register for our Sage 100 newsletter today!