Let us help you get that pesky bank account reconciled.

You have reviewed your bank statement over and over and over again. You’ve cleared the items in BusinessWorks, but your bank account still will not reconcile. Don’t throw up your hands and ignore it – read through the following to see if something below can help you get that pesky back account reconciled.

There are a number of situations that can cause your statement to not reconcile properly. The following discusses some common issues in BusinessWorks and what you can do to resolve them.

Selecting the dates & account for reconciliation

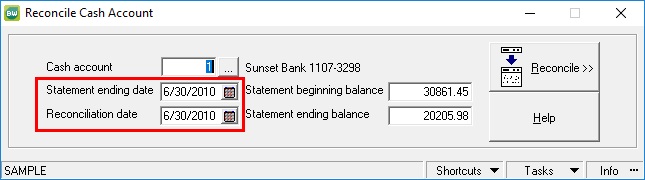

First, when reconciling a bank account, you need to be very consistent with how the dates are specified, as well as to make sure to enter the proper Beginning and Ending balances.

It is important to note if you have started the reconciliation previously, you must use the same Statement Ending Date and Reconciliation Date, or you likely will see different results in your reconciliation.

Bank transactions cleared but GL doesn’t match

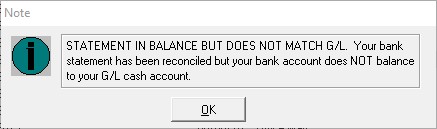

One of the most prevalent issues that occurs in the Bank Reconciliation is that all the transactions clear correctly from the bank perspective, but your General Ledger is not in balance. If you see the following message after clearing all the transactions from your bank statement, you will need to explore the reason why and decide on the appropriate action.

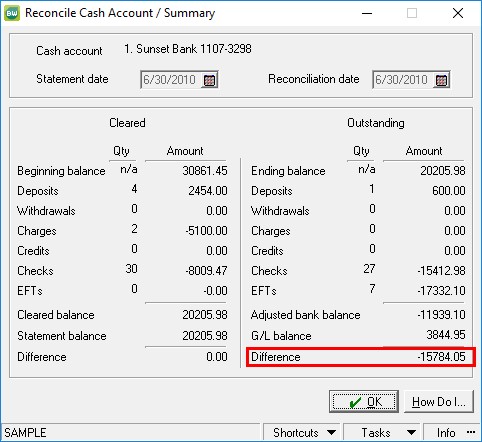

From the Bank Reconciliation screen, click on the “Reconciliation Summary” button in the bottom left to get to the following screen.

On the left side of this screen (Cleared), you see the physical bank transactions. Compared to the beginning balance, cleared transactions resolve to the statement balance. However, the General Ledger is not balanced (Outstanding). In this case, because the difference is negative, it means that there is more cash in the GL account than what is expected for the Reconciliation date. If the Difference is positive, the reverse then would be true.

Reasons why reconciliation isn’t working

One cause for this might be that Cash Receipts might have occurred earlier than the Bank Deposit that grouped them together. Another possibility is that a General Journal entry affected cash without affecting bank transaction details. You have to decide the appropriate correction that needs to be made. It might be appropriate that an adjusting Journal Entry needs to be made to balance the Difference to zero.

If your General Ledger Difference is zero, but your cleared transactions don’t balance, you might have some missing detail that needs to be entered without affecting the General Ledger.

The following are some options to enter missing transactions without posting to the General Ledger.

- For missing Payroll, Accounts Payable, or Cash Management checks, click CM, point to Transactions, click Instant Checks, and clear the Post to G/L check box.

- For missing Accounts Receivable deposits, click AR, point to Transactions, click Bank Deposits, and redeposit the checks.

- For missing Cash Management deposits or charges, click CM, point to Transactions, click Enter Bank Transactions, and clear the Post to G/L check box.

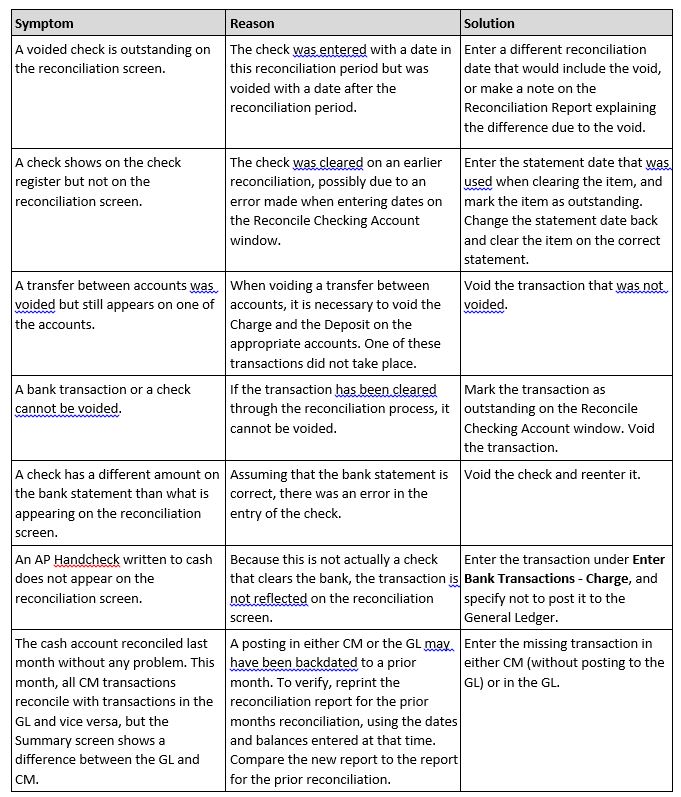

Finally, here is a summary of some detailed issues that might be causing an out-of-balance condition as well as the recommended solutions for each scenario.

Please contact us if you have questions or need assistance correcting bank statement reconciliation issues in BusinessWorks.

Register for our Sage BusinessWorks newsletter today!