How do we know if a vendor requires a 1099?

Basically, a 1099 will be issued to a vendor who is NOT an incorporated entity, and they have performed services for your organization. This could be a Business or a Sole Proprietorship. You should request W-9 information from your vendors (it is a good idea to do this every year). This document provides the Business’ name and Federal ID Number (or Social Security Number, if an individual). Attorneys, whether or not they are incorporated, should always get a 1099.

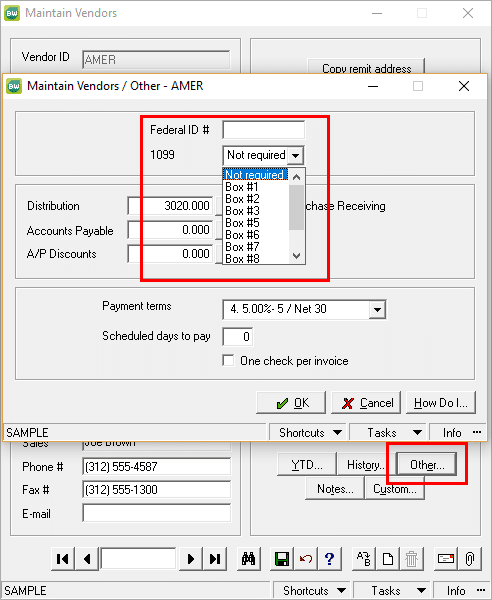

How to set up the 1099 information so that BusinessWorks can track the payments.

Go to AP > Vendors > Maintain Vendors. Select a vendor and click the OTHER button. Enter the FEIN or SSN and select the Box# that is typically used for that Vendor.

Once configured, this will categorize payments made to this vendor and make these payments accessible when processing the 1099s at the end of the year.

Even if you don’t have the complete year captured, once you start generating the 1099s, you’ll be able to correct the information prior to printing the forms. You will need to process the 1099 forms BEFORE you close the AP module for year-end. If you can’t process the 1099s before closing AP, MAKE A BACKUP that can be restored to a new company ID. You will need to be on a current maintenance plan in order to get the proper updates to process the forms.

What forms will you need?

1099 forms

- The Federal 1099 (Copy A) is printed on the preprinted red forms and will print two per page. The IRS requires you to use the preprinted red-ink form. Enhanced Tax Reporting will not print the form itself but merely fill in the fields with the vendor information and amounts.

- Recipient copy – Blank 4 part perforated form (Sage Forms #L99BLANK4 or L99BK4DWS)

Note: The back of the blank form does not have the 1099-Misc instructions. During the processing for the recipient copy, the instructions will be available to print. - State copy is printed on blank paper. The system will prompt you to print to Blank 4 part perforated but please contact individual State agency for specific 1099 printing/perforation requirements. Some states do not require 1099s to be filed.

- Payer copy (Copy C) prints 4 recipients per sheet. Print to Plain Paper or Blank 4 part perforated.

1096 form

- The Federal 1096 copy is printed on preprinted red forms. The IRS requires you to use the preprinted red-ink form. Enhanced Tax Reporting will not print the form itself but merely fill in the fields with the vendor information and amounts.

- State 1096 copy is printed on plain paper. No need to purchase forms.

Review the detailed instructions for the 1099-MISC form at https://www.irs.gov/instructions/i1099msc.

For more information regarding year-end information on 1099s, or if you need assistance in Sage BusinessWorks, please contact our Sage BusinessWorks support team at 260.423.2414.

Register for our Sage BusinessWorks newsletter today!