It’s that time of year – wrapping up payroll and processing employees’ forms. One of the new pieces of information that is to be included on the W-2 forms is that of the Employer-Provided Health Coverage.

There are a number of ways this can be handled, but at this time of year, we’ll look at modifying the data directly in the Enhanced Tax Reporting and eFiling (as powered by Aatrix) function.

Basically, once the process has started to prepare your W-2s, and you’re in the data reviewing it before you choose to eFile or print your forms, you can adjust the information that will be displayed on the employees’

W-2.

The following will guide you through making the manual changes to Aatrix in order to report Employer-Provided Health Coverage (this presumes that you do NOT have an existing deduction code which tracks the Employer Contribution via Payroll Entry.)

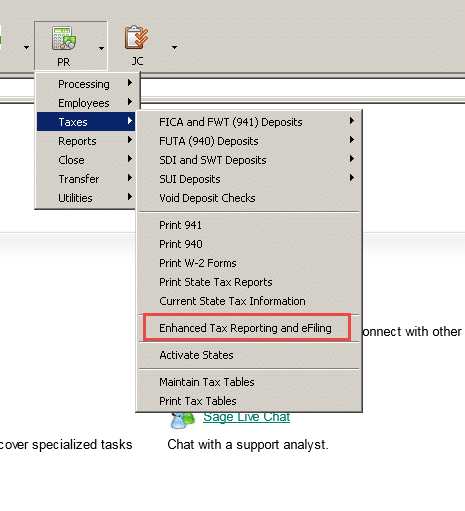

Under Payroll > Taxes, select Enhanced Tax Reporting and eFiling (you MUST have an active subscription plan in place with Sage in order to receive the appropriate updates and run this function.

Once you have accessed the Enhance Tax Reporting and eFiling, take Automatic Updates if prompted. Select the W-2/W-3 form and click OK.

Follow the wizard through the prompts until you get into the editable spreadsheet. Along the column header, right-click to get the following menu.

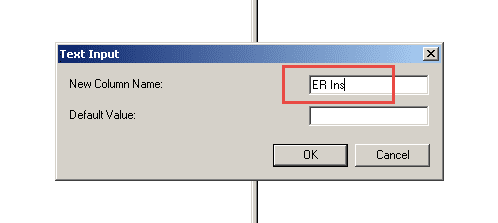

Insert a column and offer some sort of name as follows:

A new “Unassigned” column will be created. Go to the drop-down and pull the menu as follows:

Add the dollar amounts directly into Aatrix to be reported on the employees’ W-2s.

If you have questions or need assistance adding employer contribution to employees’ W-2s in Sage BusinessWorks, please contact our BusinessWorks support team at 260.423.2414.

Register for our Sage BusinessWorks newsletter today!