What’s a Reversing Journal Entry, and why would I need one?

Should I void an entry instead?

There are often situations in accounting where a journal entry gets made but then needs to be “reversed” at the beginning of the next month. Companies might accrue payroll expenses to recognize the time worked in one month but paid in the following month. There are other situations where an entry was made by mistake, and its effects need to be completely removed. This is where “voiding” an entry could be helpful.

Sage BusinessWorks offers a means to automate a Reversing Journal Entry. You post a transaction for a date in a given month, and then Sage BusinessWorks will create another entry, with all the posted amounts in the opposite direction as of the first of the next month.

To set up a Reversing Journal Entry

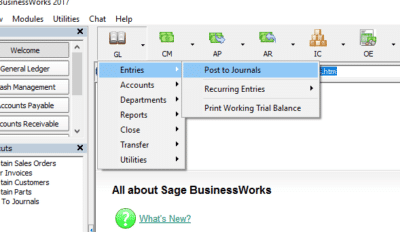

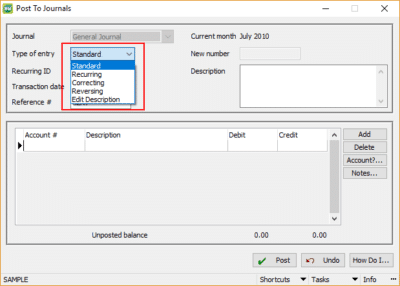

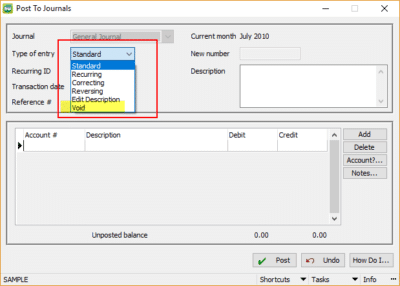

Go to General Ledger > Entries > Post to Journals.

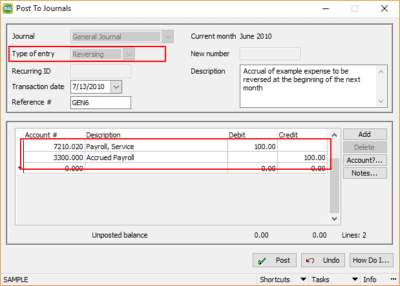

Select the type of entry to be “Reversing”, and fill in the information as a typical entry.

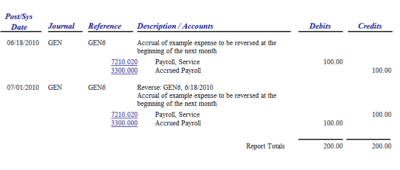

Post the entry. The REVERSAL will not show up until GL Close is performed. At that time, BusinessWorks will create an “opposite” entry and date it for the first of the following month.

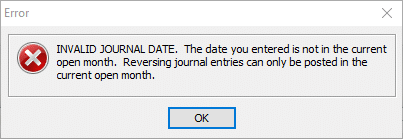

NOTE – you can only create a Reversing Journal Entry in the CURRENT open month.

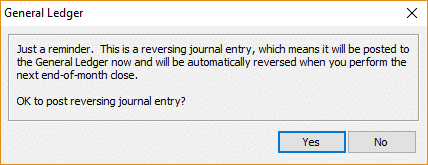

When you Post the entry (with a valid date), BusinessWorks will prompt you with the following:

Click Yes to allow the Reversing entry to post.

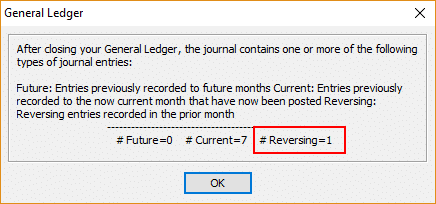

When you process your Period End Close in the GL, you’ll see statistics regarding entries that were processed.

You can then view reports or account inquiries and see the effects of the Reversed transaction(s).

There might be other situations where an entire entry might need to be removed. Traditionally, a second entry is manually keyed that is the exact opposite of the original entry. Depending on the complexity of that entry, it could be prone to mistakes.

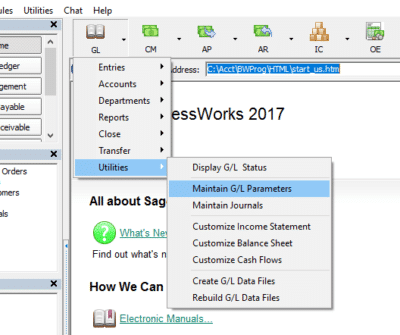

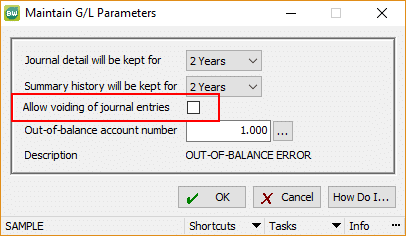

BusinessWorks offers a “Void” capability. However, this must be enabled through GL Parameters.

Before:

Configuration:

Once enabled:

When VOID is selected as the type of entry, you are offered a selection of entries that may be voided.

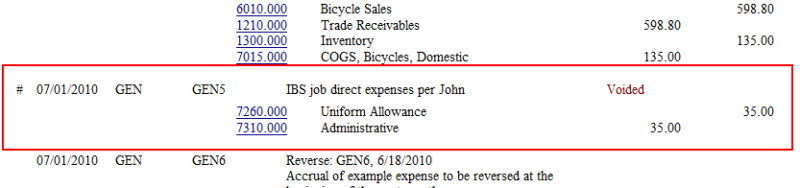

Click on the lookup (“…” button) next to the Reference # field and select the entry to void. You can view reports or other inquiries to see the results.

Even though the amounts still show, they will not be figured into the totals of whatever report you’re viewing.

As you can see, Sage BusinessWorks offers ways to simplify data entry by allowing for the creation of reversing journal entries or automating the removal of incorrect entries through the Void capability.

If you have questions or need assistance with reversing and voiding journal entries in Sage BusinessWorks, please contact our support team at 260.423.2414.

Register for our Sage BusinessWorks newsletter today!