The end of 2024 will be here before we know it. In hopes of making your year-end closing more efficient, we have prepared a Sage Intacct year-end closing checklist. This blog includes our recommended closing steps as well as instructions on how to leverage the checklist functionality found in Sage Intacct.

You do not need to create a checklist to perform the closing steps, however you might find a checklist helpful in keeping track of due dates, assignments, etc. We will discuss creating the checklist in Sage Intacct at the end of this blog.

Here’s our recommended Sage Intacct year-end closing steps.

1. Make sure all subledger transactions are recorded

- Verify that all Accounts Payable transactions that should be properly recorded in 2024 are entered.

- Verify that all Accounts Receivable invoices and payments for 2024 have been entered.

- Generate Fixed Asset module depreciation entries and Prepaid Expense Amortization entries.

- Verify that all third-party systems are synched to Sage Intacct. This includes expense software such as Bill.com or payroll provider software.

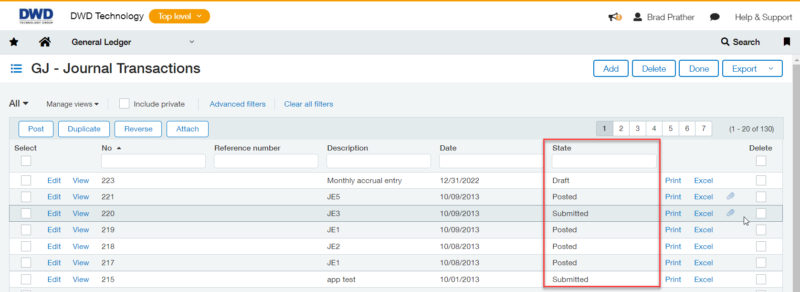

- Verify that all transaction in a Draft state have been posted or submitted.

- Verify that all transactions submitted for approval have been approved.

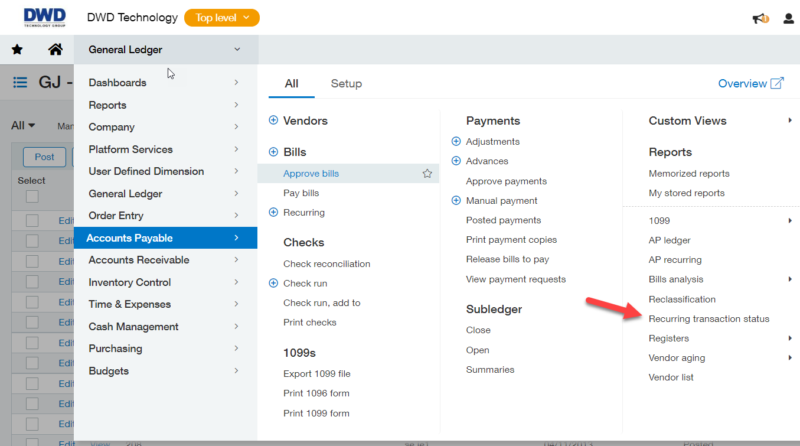

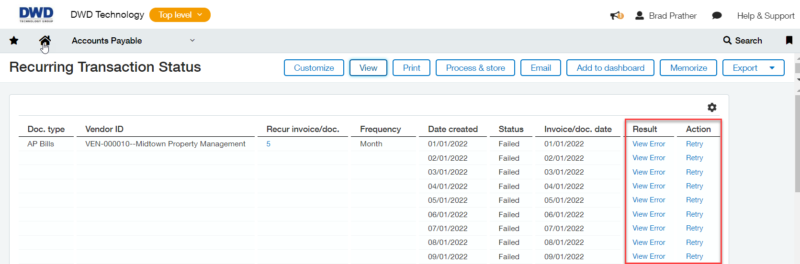

- Verify that all recurring transactions have been posted. Each module with the ability to setup recurring transactions has a recurring transaction status report. This report will allow you to view the error as well as retry posting the transaction once you’ve corrected the error.

2. Reconcile Subledgers to the General Ledger

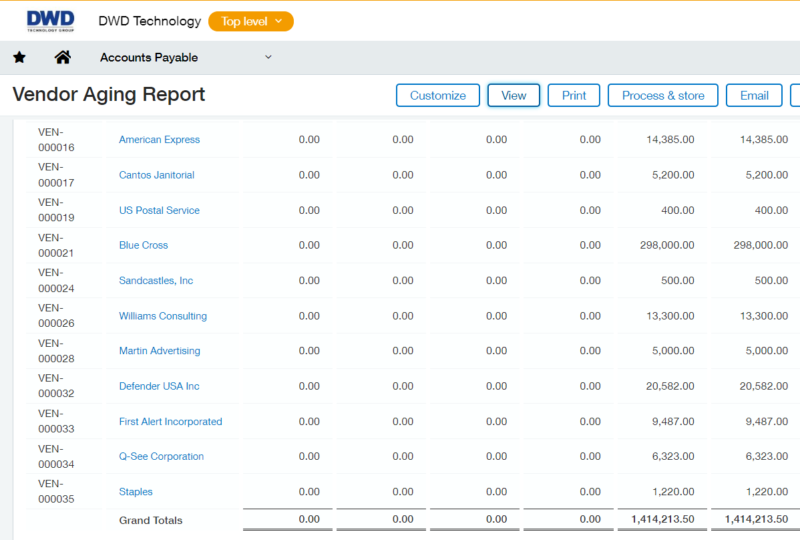

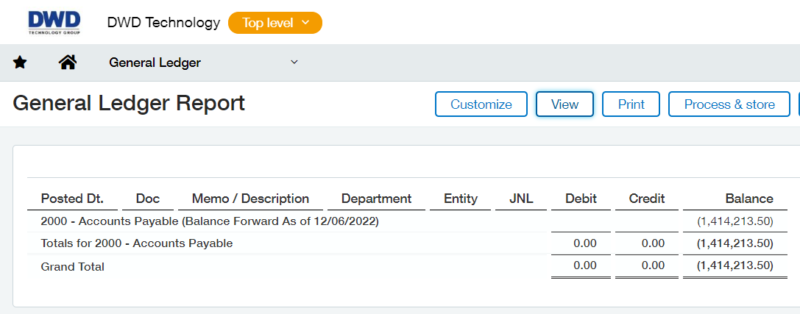

- Run the A/P Aging Report as of 12/31/2024 and the General Ledger report for the Accounts Payable account as of 12/31/2024. Compare the totals and reconcile any differences.

- Run the A/R Aging Report as of 12/31/2024 and the General Ledger report for the Accounts Receivable account as of 12/31/2024. Compare the totals and reconcile any differences.

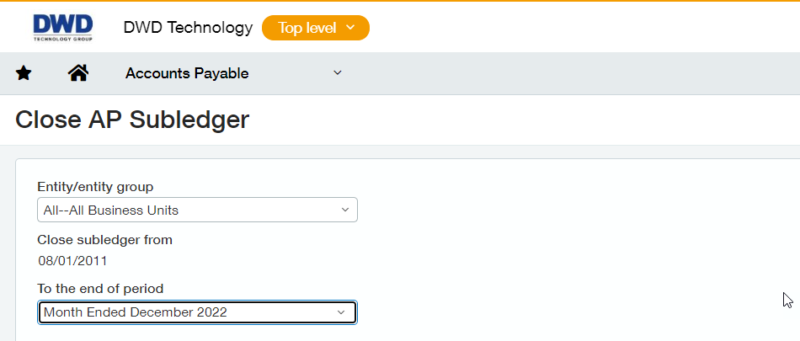

3. Close the Subledgers

- Go to the appropriate subledger > All > Subledger > Close.

- Each subledger is independent, which is beneficial if you are still working on closing out other subledgers.

- If you’re a multi-entity company, you can close all entities or each one individually as you complete them. (Tip: You can skip this step and wait until step 7. When you close the General Ledger, then all subledgers are automatically closed.)

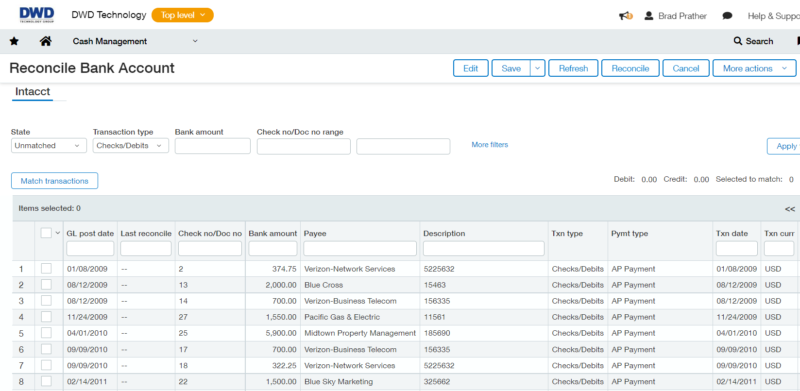

4. Reconcile Bank Accounts

- Go to Cash Management > All > Reconciliation > Bank.

- Select the applicable bank account and enter the bank statement information.

- Match the cleared transactions until the amount to reconcile equals $0.00.

- Generate the reconciliation report and save it. (Tip: Sage Intacct also has bank feed functionality that will allow you to clear transactions automatically based on rules you create. You can also download a file from your bank and import it using the same rules to clear bank transactions.)

5. Post Month-end and Year-end Journal Entries

These journal entries include accruals, allocations, deprecation, payroll, and any memorized transactions. There are several ways to automate this process.

- Importing journal entries

- Creating memorized transactions

- Utilizing Dynamic Allocations

6. Generate the Financial Reports

7. Close the General Ledger

Go to General Ledger > All > Books > Close. Just like the subledgers, you can close all entities or each one individually.

How to Prepare Your Own Sage Intacct Year-end Close Checklist

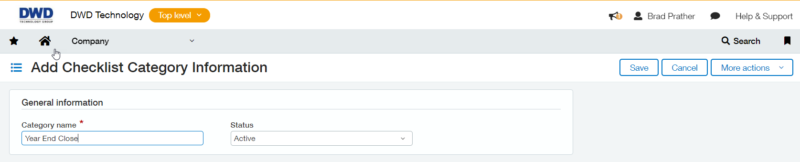

If you decide to prepare a checklist, the first step is to go to Company > Setup > Checklists > Checklist Categories. Click Add. Create a category called Year End Close and set its status to Active. Click Save.

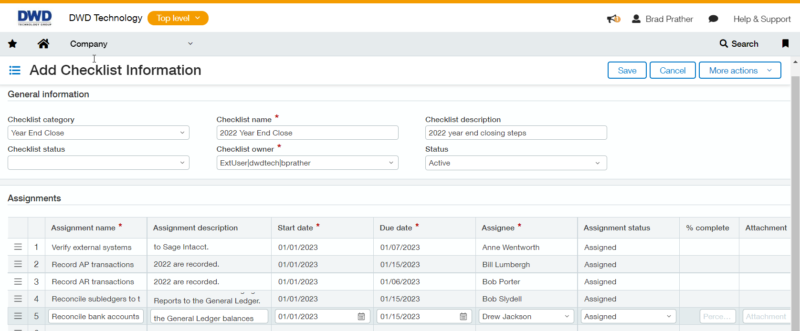

Go to Company > All > Checklists. Click Add. Select Year End Close as the category. Enter a checklist name. We recommend incorporating the year in the name. Select a checklist owner. Add your year-end assignments, start dates, end dates, and assignees. You can also add attachments to each assignment. Save the checklist.

If you have questions with any of the information above or need assistance with year-end processing, please reach out to DWD’s Sage Intacct team today at 260.423.2414.

Register for our Sage Intacct newsletter today!